Opportunities to produce Values-added Products.

Table of Contents

- Chapter # 1 ————-Copper

- Chapter # 2 ————-World Reservoirs

Copper Deposits

Copper Consumption - Chapter # 3 ————Worldwide Value-Added Copper Products

- Chapter # 4 ————Copper Deposits of Pakistan

- Saindak & Capacity of Existing Project

- Rekodiq & Capacity of Existing Project

- Chapter # 5 ———– – Investible Export Oriented Projects

- Business Model of a Copper Value Added Project

- How to further Exploit Potentials in Copper Mining

- Chapter # 6 ————Recommendations

Annexure

Annexure- 1 List of World Copper Mining Companies

Annexure -2 List of World Copper Product Manufacturing Companies

Chapter # 1

Copper

Copper is an element that has universal availability and is found worldwide especially in the volcanic areas possessing high levels of sulfur concentrations.

Copper is a very important element and the oldest known commodity in the world that directly affects the world’s economy. It stands at the third place in context of the world consumption after steel and aluminum. It is largely used in electrical appliances, as it is the cheapest metal, which is a good conductor of electricity. It is also considered safe as a raw material in wire making.

Copper is extracted from its ore such that as sulfides and carbonates. The ore mines are located both on land as well as in the deep seas and it is estimated that the total world resources of copper accounts to around 2.3 billion tons. The maximum share in this production figure is constituted by Chile & United States contributing to 18% each. About 80% of all copper extracted comes from sulphide ores. A typical ore contains only 0.5% to 2.0% copper. It is a measure of the value of copper that it is worth extracting from such small concentrations. The ore is a mixture of minerals and rock (called gangue).

Copper can also be extracted from its waste scrap, contributes to a larger extent in the world’s total production. Many types of copper ore found throughout the world. Copper is a reddish colored metal. If we talk about its properties; its symbol is Cu, atomic weight is 63.546 and atomic number 29. After iron, copper has been used throughout human history.

Copper name copper originated from Latin cuprum or Cyprian Meta. We can say like most English words , copper also originated from Latin.

Copper deposits mostly belong to two main classes: Oxidized Ore and Sulfide Ores. Other types are Volcanogenic massive sulfide, Iron oxide copper gold.

The most common copper minerals are:

| Mineral | Appearance | % copper in mineral |

| Cuprite | Red, earthy | Calculate from molar mass of copper |

| Chalcocite | Dark grey, metallic | Calculate from molar mass of copper |

| Bornite | Golden brown, metallic | 63 |

| Malachite | Bright green, earthy | 58 |

| Azurite | Blue, glassy | 55 |

| Chalcopyrite | Golden yellow, metallic | 35 |

Number of Copper mix minerals have been found in all the four provinces of Pakistan associated with porphyries, skarn, hydrothermal veins, replacement of breccias, volcanogenic sedimentary including massive sulphide.

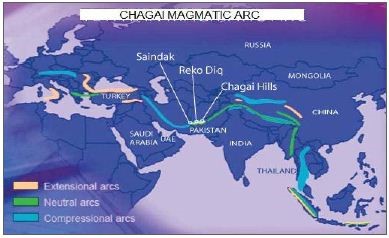

The significant Copper deposits in Pakistan are, however, relate to two categories i.e. porphyry type and volcanogenic. Chagai magmatic arc is the most important district where more than 27 significant occurrences dominantly of porphyry type have been reported.

Is COPPER, a better investment than Silver and Gold?

There is an investment school of thought who says that a base metal like copper is a better investment option compared to gold and silver. Ben Benedict, a base metals expert based in Singapore, said that “While India is trying to accumulate gold reserves, China is going one step forward by accumulating copper stocks!”

“Copper stocks are better investment opportunities for emerging countries. So, I would go with China, not with India,” pointed out Benedict.

Chapter # 2

World Reservoirs

During the year 2021, global consumption of copper was 25 million metric tons. In 2022, global copper mining production stood at 22 million metric tons. Chile is the largest producer of copper with reserves of top 4 mines with capacity of over 1.5 million tons.

World Copper Deposits

Top Countries of Copper Reserves (Million tons)

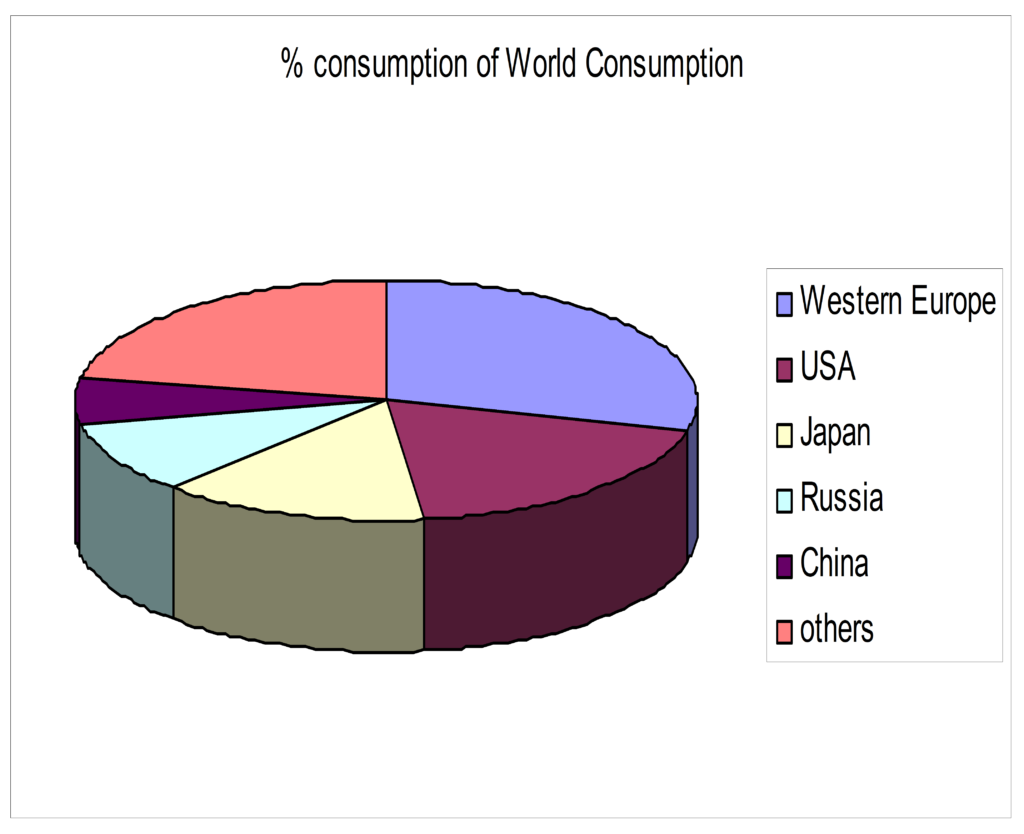

Worldwide Consumption of Copper

Copper stands at 3RD position among the most consumed metals in the world after Steel and Aluminum. China is the World largest Copper Consumer with about 38 percent along with a record level of copper imports.

Copper is an important Commodity that is traded mainly in

- London Metal Exchange (London)

- New York Mercantile Exchange (New York)

- Shanghai Futures Exchange (China)

- These commodity exchanges direct the World Market in the context of prices.

An Economic Precursor

Either a currency or a New Precious metal, one thing for sure is that copper is the bellwether of the economy because it is mainly used in housing, power generation and other cyclical sectors. Copper price dynamics over coming years could serve as a precursor to see if Asia can shift its focus from an export-oriented model to one that’s more internal consumer based, as well as a realistic gauge of the global economy.

Chapter #3

Copper Products & Uses

Few very common Uses of Copper Globally:

- Copper is an essential component in the motors, wiring, radiators, connectors, brakes, and bearings used in cars and trucks.

- The average car contains 1.5 km (0.9 mile) of copper wire, and the total amount of copper ranges from 20 kg (44 pounds) in small cars to 45 kg (99 pounds) in luxury and hybrid vehicles.

- Copper is used in construction and electrical applications including power generation and transmission, telecommunication, and electronics. (75% of copper being utilized)

- Copper wiring and plumbing are integral to the appliances, heating and cooling systems, and telecommunications links used every day in homes and businesses.

Business Prospects in Copper Value Added Products

- Copper Insulated Products

Generators for Wind Power, Building wires for power transmission, Paper coverings, Mica coverings, Transformers, Household equipments, Other Insulated products. - Copper Wires

Electrical Conductors, Switch Terminals, Hard wares used in electrical circuits, electrical Contacts, household wiring, cable manufacturing, air cooled, transformers, enameled copper wires, braided flex, armature assembly, and insulated cables. - Copper Rods

Copper rods with high precision are high in demand for various application purposes in domestic as well as global market. These copper rods are carved from high grade quality raw material e.g. electrolytic copper. These copper rods are extensively used in electrical industries for the following purposes.- Earthings

- Panels electrification lines

- Anodes

- Copper Wire Rods

Copper wire rods (copper c.c. rods oxygen free) are using superior quality raw material which are checked through international standards. These copper wire rods are high in demand for various industrial purposes and are highly acknowledged for their outstanding characteristics. Electrical industry & Engineering industry are the application areas.

Electrical Copper Products

- Copper Plates

Copper plates are for earthing which are high in demand in different industries for various applications. Some of the applications of Copper Plates is as follows: Defense, Port, Petrochemical & refineries, Fertilizer plants, Power plants, nuclear power reactors, Oil & gas refineries, Paper industry, Cement industry, Sugar industry, Oil mills and many more. - Copper Cakes

- Copper Tubes and Pipes

Copper tubes and pipes with high grade quality raw material are in demand in Heat exchangers, Oil coolers, Air conditioning, Refrigeration equipments, Electrical heating coils, Industrial Components

Chapter # 4

Copper Deposits of Pakistan

Pakistan lies on the massive transcontinental geological belt that runs through the earth’s crust from Eastern Europe right across to Magnolia. This is the Tethyan Magma-tic Arc which is one of the least explored of the world’s major copper deposits.

Pakistan lies on this Belt which is unfairly known in the West as “The Devil’s Triangle” as its three sides border Iran, Afghanistan, and Pakistan.

Pakistan’s Copper Deposits

Saindak Copper Deposits & its Investment Potential

- Site Location – 9.4 km South-east of Fort Saindak, (Latitude 29 14, longitude 61 37) District Chagai, in the north-western corner of Baluchistan at 18 and 40 km.

- Area: 1284 Acres

- Current Condition Proven 78 million tons of copper. (Leased to Chinese Company)

Exploration and Evaluation

- Based on exploration data collected by SML in 1978-79, pre investment study was carried out by Seltrust U.K. the study determines a total of 412 million tones of ore in three bodies i.e. East=373 Mt, North=28 Mt and South= 111 Mt.

- It recommends the South Ore body to be mined first as it contained higher values of copper and gold.

Saindak Investment Potential:

- The project based on 400 million tons of Copper Ore is developed to produce 15000 tons Copper, 1.5 tons Gold and 2.74 tons Silver annually during the project life of 19 years.

- In April 2000, as per decision of the Cabinet, Saindak Project was awarded to Metallurgical Construction Company (MCC) of China on the terms and conditions that MCC would pay US$ 0.5 million annually as rental and 50% of the profit on sales. Pakistan has so far earned around US$ 89 millions from 2004 to 2008.

Capacity of the Existing Project Leased to MCC:

- Saindak Copper –Gold Project has a capacity to produce 20,000 tonnes of blister copper per year containing about 1.5 tones of Gold from indigenous ores generating foreign Exchange Revenue to the tune of US $ 40-45 Million/year. (Southern Part)

- SML has one 5*10 MW power plant to meet its industrial and well as domestic power requirement.

- SML has well maintained water supply system for industrial and domestic requirements.

MCC in Saindak Deposits

- A Copper-Gold Project was established at a total cost of US$ 400 million, on proven reserves of 78 million tons of Copper Ore. Recently it has been leased out to Metallurgical Construction Corporation (MCC) OF China for a period of ten years.

- The TCC has signed with GOP prior to make the investment of US$ 170-200 million to the project. The interest of TCC & BDA in the joint venture are 75% and 25% respectively.

- Both Companies requested Government to declare the district Chagi as Export Processing Zone to not to pay normal taxes

- The Company is yet to finalize leased terms with GOB.

Reko Diq Copper Deposits and its Investment Potential

Reko Diq Deposits rank No. 6 in its Gold contents of 0.29g/ton in the world reserves of Copper Deposits bearing Gold.

The other 05 big deposits in gold content are Kad Zahran of Armenia (0.65g.ton), Peschauka of Russia (0.42g/ton), Bingham of USA (0.38g/ton), Chupadada of Brazil (0.35g/ton) and Kennun South of Philippines (0.33g/ton).

TCC to finalize the implementation program in respect of the actual annual production of Copper & Gold on completion of the feasibility report in January 2010. TCC, however, has tentatively planned to invest US$ 3 Billion for the development of the project.

Current situation of Copper Value-Added Industry in Pakistan

Very Dismal Scenario……….National Wealth Unutilized

There is an essential requirement of Copper Products particularly Copper Wire for domestic cum industrial uses in Pakistan as well. Since there is no progress on development of indigenous raw material therefore, the Copper industry is very small in size, devoid of any modern technology and relying on imported material.

Locally Copper wire is being produced by three main Industries that produce 50-70 tons of copper wire over 24 hours by using the imported furnace plant from China and Europe. These industries are as under:

- Allied Group of Industries, Karachi

- Prime Metals, Gujranwala

- Universal Cables, Lahore

Other Small & Medium Enterprises for copper wire manufacturing are also present in different cities of Pakistan motioned as under

- Naushad Metals

- Yahya Metals

- Sarwar Metals

- EMS Metals

- Gulzar Metals

These SMEs produce 2.5 tons of copper wire. These local industries use local made furnace for copper wire production (traditionally called Gothali) based on imported Used electric appliances from Europe and extract copper material for making copper wire for domestic use in the country.

Proposals for developing Investible Export Oriented Projects

- Business Model of a Copper Value Added Project

- To Further Exploit Potentials in Copper Mining

- Infrastructure development

- Missing links

Business Model of a Copper Value Added Project

Copper Refining & Copper Wire Manufacturing Industry

NB (All figures were estimated in 2011, can be updated ,if needed)

- Proposed Line of Production

Production of Copper wire thorough indigenous raw material. - Future production plan / item to be produced / manufactured.

Copper Wire, Tin Coated Copper Wire, Braided Copper Wire, Tin Coated Rounded flat, and Tinsel Copper Wire to be produced from copper exploited & developed from mines of Pakistan. - Copper Refining Process

Copper Production from Ore to Finished Product

From its original home buried underground in a mine to its use in a finished product such as wire or pipe, copper passes through several stages. When it is recycled it can pass through some repeatedly. Below is a quick description of the path.

1. Mining, Crushing

The beginning for all copper is to mine sulfide and oxide ores through digging or blasting and then crushing it into walnut-sized pieces.

2. Grinding

Crushed ore is ball or rod-milled in large, rotating, cylindrical machines until it becomes a powder usually containing less than 1 percent copper. Sulfide ores are moved to a concentrating stage, while oxide ores are routed to leaching tanks.

3. Concentrating

Minerals are concentrated in a slurry that is about 15% copper. Waste slag is removed. Water is recycled. Tailings (left-over earth) containing copper oxide are routed to leaching tanks or are returned to the surrounding terrain. Once copper has been concentrated, it can be turned into pure copper cathode in two different ways: Leaching & electro winning or smelting and electrolytic refining.

4a. Leaching

Oxide ore and tailings are leached by a weak acid solution, producing a weak copper sulfate solution.

5a. Electro winning (SX/EW)

The copper-laden solution is treated and transferred to an electrolytic process tank. When electrically charged, pure copper ions migrate directly from the solution to starter cathodes made from pure copper foil. Precious metals can be extracted from the solution.

OR

4b. Smelting

Several stages of melting and purifying the copper content result, successively, in matte, blister and, finally, 99% pure copper. Recycled copper begins its journey to finding another use by being re-smelted.

5b. Electrolytic refining

Anodes cast from the nearly pure copper are immersed in an acid bath. Pure copper ions migrate electrolytic ally from the anodes to “starter sheets” made from pure copper foil where they deposit and build up into a 300-pound cathode. Gold, silver and platinum may be recovered from the used bath.

6. Pure Copper Cathodes

Cathodes of 99.9% purity may be shipped as melting stock to mills or foundries. Cathodes may also be cast into wire rod, billets, cakes or ingots, generally, as pure copper or alloyed with other metals.

7. Cathode is converted into:

- Wire Rod – Coiled rod about 1/2″ in diameter is drawn down by wire mills to make pure copper wire of all gages.

- Billet – 30′ logs, about 8” diameter of pure copper are sawed into these shorter lengths which are extruded and then drawn as tube, rod and bar stock of many varied sizes and shapes. Rod stock may be used for forging.

- Cake – Slabs of pure copper, generally about 8″ thick and up to 28′ long, maybe hot – and cold-rolled to produce plate, sheet, strip and foil.

- Ingot – Bricks of pure copper may be used by mills for alloying with other metals or used by foundries for casting.

- Manufacturing Process

Copper Wire Manufacturing Process:

- Drawing Process: EC grade continuous cast copper rod of 8mm diameter used for drawing into different gauge wires.

- Annealing Process: After drawing operation, the coil of drawn wire are put into electric furnace in a pot for getting it annealed soft wire.

- Bunching/Stranding Process After the wire is annealed, it is wound on reels and are put on bunching /Stranding on the wire stranding/bunching machine for getting different size range of bunched/stranding wires are then passed through nuzzling process for better surface of wire.

- Tinning Process: There are two processes of tinning.

- Hot Dip Process In the hot dip process the tin is pickled and the wire passes through the pickled tin getting coating on it and wound on reels.

- Electroplating Process There is a separate plant for Electro-plating process and the plating is done through dipping of wire in chemical bath and passes eclectic current in it for required coating.

- Braiding: After Annealing Process, the wire is wound on reels and put on Braiding/Twisting Machines for making different sizes of Braided Wire in accordance with the specification.

- Process for Tinsel Wire Fine gauge Copper Wire duly wound on reels is put on flattening machine for getting it flattened. After this process the wire is put on Lapping Machine for getting lapping of nylon thread. After this process is complete, the wire is put on Braiding /Twisting Machine for braiding of wire to required size and then the wire is processed for chemical coating on required machine.

- Process for Glass Wire: Tinned Copper wire bunching is done on Bunching Machine and then wire is put on Lapping Machine for lapping of PP. After this process is over the wire is put on Braiding Machine for braiding of fiber glass coating and then put on the machine for varnish coating on the wire.

- Details of local/Foreign technical collaboration

Foreign technical collaboration is required for investing in this Project. There is no local Manufacturing of Copper. As to be specified-Proposed joint venture products or copper wire, therefore it would be essential to attract investment for setting up / operate the plant on a joint venture on public cum private module with subsequent transfer of technology can be affected.

- Details of local/Foreign technical collaboration

Production Capacity

Plants are classified as size.

| Plant Scale | Copper Consumption | Production Capacity |

| Medium Plant | 250 Tons/Month | 350 Tons/Month |

| Large Plant | 1500 Tons/Month | 2000 Tons/Month |

Manpower Requirement:

| S.No | Category | Local Employment | Foreign Employment | Total Employment |

| 1. | Managerial | 20 | 05 | 25 |

| 2. | Technical | 500 | 20 | 520 |

| 3. | Highly skilled | 100 | 10 | 110 |

| 4. | Semi skilled | 500 | – | 500 |

| 5. | Unskilled | 200 | – | 200 |

| Total | 1320 | 35 | 1355 |

Power Consumption and the Related Facilities

Water Requirement (KL/Month)

| Medium Plant | Large Plant |

| 6,000 | 28260 |

Plant Site Planning

- Abundant electric power supply and water supply

- Abundant labor

- Convenient transportation

- Low humidity and far from the seashore Requirement (KW)

Investment Required for the Project:

Capital Investment (Estimates worked out in 2011,can be updated if needed)

| S.No | Details | Amount US $ |

| 1. | Cost of Copper Wire Plant/Machinery/Equipment (Estimates) | 5,000,000 |

| 2. | Infrastructure Requirements/Utilities | 500,000 |

| 3. | Cost of Land (Cost in Gwadar is Rs 200,000 per acre however infrastructure is not developed ideally location could be Hub where comparatively developed industrial sites are available | 1000,000 |

| 4. | Construction Cost of Building | 10,460,000 |

| 5. | Furniture / Fixture/ Equipments | 2500,000 |

| Total | 19,460,000 |

Cost of Production (Estimates)

| S.No | Variable Cost | Amount US $ |

| 1. | Operational Cost/Transportation/ Selling Expenses | 6,315,900 |

| 2. | Utility Charges | 55,000 |

| 3. | Wages & Salaries | 3,583,100 |

| 4. | Cost of Raw Material | 45,954,000 |

| 5. | Depreciation/interest/Pay backs | 1500,000 |

| 6. | Other overheads | 2,000,000 |

| Total Variables | 59,408,000 |

Profit & Loss Account:

| Copper Industry | Refined Copper | CAA Wire | Total | ||||||

| For the production of 6,000 tons Copper Wire | Figures in USD | ||||||||

| Net Sales | 65,252,000 | 16,948,000 | 82,200,000 | ||||||

| Cost of Production | (44,012,000) | (15,396,000) | (59,408,000) | ||||||

| Gross Profit | 21,240,000 | 1,552,000 | 22,792,000 | ||||||

| Selling & Administrative Expenses | (746,000) | ||||||||

| Operating Profit | 22,046,000 | ||||||||

| Figures in % | |||||||||

| Net Sales | 79.4% | 20.6% | 100% | ||||||

| Cost of Goods Sold | 74.1% | 25.9% | 100% | ||||||

| Gross Profit | 93.2% | 6.8% | |||||||

| Gross Profit (as a percentage of sale) | 32.6% | 9.2% | 27.7% | ||||||

| Selling & Administrative Expenses | 0.9% | ||||||||

| Operating Profit | 26.8% | ||||||||

E.H.S Compliance

- Fire Safety System

- Identification type of effluent discharge

- Solid Water Management

- Effluent treatment plant

- Periodical Medical check up for employee

Export Projection for 5 Years

| Annual production metric tones | Date of Commencement of Export | 1st year of Export | 2nd year of Export | 3rd year of Export | 4th year of Export | 5th year of Export |

| 24,000 | Tentatively 2 years | 26,000 | 26,500 | 27,000 | 27,500 | 28,000 |

Project Summary

Committed quarter production ———–6000 MTofRefined Copper &Copper Wire

Cost of Production—————————-US$ 59,408,000

Presumptive Tax——————————1%

Royalty to Provincial Govt. —————-Variable

Agreement Annual Fee———————-Variable subject to contract

Net Sales Revenue—————————-US$ 82,200,000

B. To Further Exploit Potentials in Copper Mining

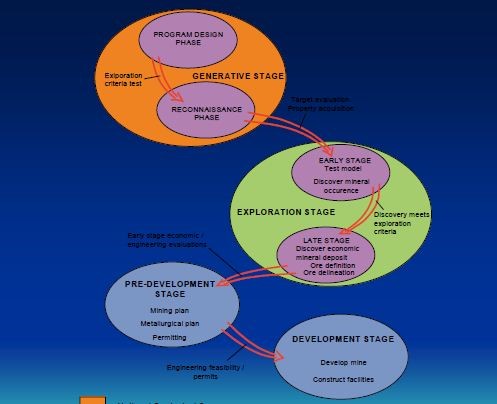

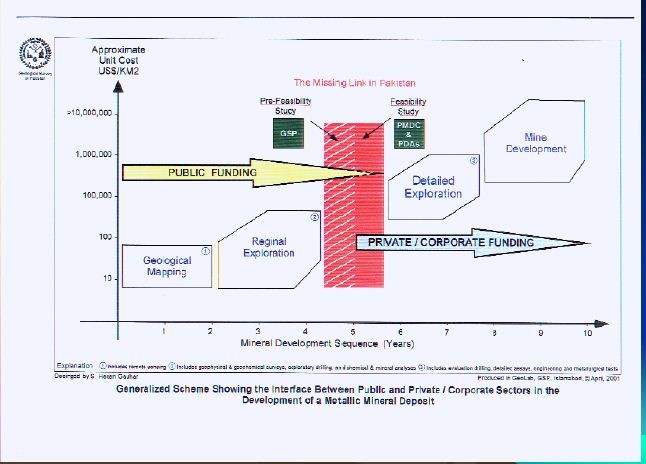

Mineral Policy of Pakistan is found to be rather being Complex and risky. Require Large Capital Investment, long gestation Period and multi disciplinary approaches for development as is evident from the following diagram.

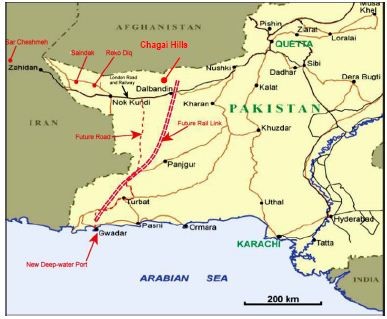

Trade Route via Gwadar

The Missing Link in Pakistan in Mineral Development:

Infrastructure Development for Exploration

- Arid Climate with low precipitation is perfect for year-round exploration.

- Wide-Gauge heavy duty railway line was upgraded for the Saindak Cu-Au Mine

- Federal and Provincial Government Committed to building new roads/railway connecting regions with new Gwadar Sea Port.

Chapter # 5

Recommendations

More than 1882.5 million tons of Copper reserves are presently found in Pakistan. The development works completed on only south ore body of Saindak. This complete project was developed out of Public Sector Development Fund and leased to M/S MCC of China on a 10 years lease. The experience shows that no value added product out of indigenous copper was produced, instead all the explored metal was exported to China for value addition there. Local Copper value added industry is very small scale deprived of local material and relies on imported material for small scale manufacturing for domestic / consumer products.

Following Proposals are made for establishing value added chain in this metal industry.

- Consortium of Foreign interested groups may be formed to create a body for exploration rights of copper and for establishing value chain industry in Copper Products viz Copper Wire.

- The above can be governed under Public cum Private Partnership since the Govt. has already laid infrastructure in the Saindak Project, therefore future Public Funding would be marginal.

- The 10 years contract of MCC OF China for Saindak project would expire in 2011 whereas Govt. of Baluchistan is reluctant to finalize Agreement with BHP for Reko Diq.

- The local Copper industry, which is keen to make investment in this sector may be given opportunity to upgrade their skills. In case, if the Mining lease Agreement with the Foreign Company is renewed, A clause may be negotiated binding the company to either sell part of the metal.

- to Locals or set up own manufacturing plant in the vicinity of Saindak, Gwadar or Hub/

References

Visited

- Geological Survey of Pakistan

- Allied Group of Industries

Telephonic Inquiries

- Naushad Metals Gujranwala

- Copper Wire Manufacturing Industries in India

Websites Visited

- London Metal Exchange

- Projection of cost & benefit Analysis from internet sources

- Copper Mining Companies

- Copper Value added industries.

Shahida Qaiser is the author assisted by Afshan Uroos, Economist and Junaid Feroz, Marketing Professional.

Shahida Qaiser holds Master’s degree in “International Relations” -KU. Geography as Graduation major -Punjab Uni. Certifications.: “Trade Promotion” KOICA- Korea, “ Trade &Investment “ by Mincom, CCPIT & Renmin Uni-China, “ Industrial expansion” by EEC in Ireland, Netherlands & Belgium, “EXPRO”-Eng & Metal Working” Hague & Hannover by CBI-Holland ,” BLS/AED/1st Aid “- Qatar, “Women Executive” British Council-Karachi